The Enterprise AI Landscape: Categories, Leaders, and What’s Actually Working

Discover which enterprise software categories are leading the AI transformation and how top products—Microsoft Copilot 365, Salesforce Einstein, and Databricks AI—deliver measurable ROI. Explore strengths, limitations, and adoption considerations for modern AI driven organizations.

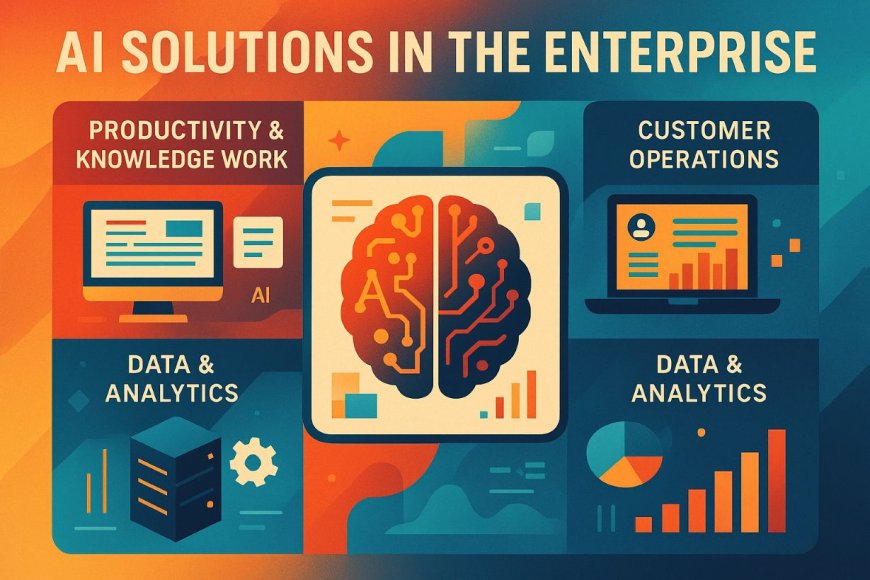

1. Enterprise Solution Categories Making the Fastest AI Progress

Across the reports and analyses surfaced in your searches, three enterprise categories stand out as the most aggressively investing in AI and redesigning their products around it:

1. Enterprise Productivity & Knowledge Work Automation

· Driven by copilots, agentic workflows, and embedded LLMs.

· Microsoft Copilot 365 is cited as the highest ROI enterprise AI tool in large-scale deployments. (Source: https://axis-intelligence.com/)

2. Customer Operations & CRM Automation

· AI is reshaping sales, service, and marketing workflows.

· Salesforce Einstein is highlighted as the dominant AI platform for customer operations, with measurable conversion gains. (Source: https://axis-intelligence.com/)

3. Data & Analytics Platforms (AI-native analytics)

· Enterprises are shifting from BI dashboards to AI-driven insights and automated decisioning.

· Databricks AI is identified as the leader in analytics transformation, with massive growth in production AI models and vector database adoption. (Sources: https://axis-intelligence.com/ and https://www.databricks.com/)

These three categories also align with the largest enterprise AI investment buckets identified in the Menlo Ventures report (https://www.globenewswire.com/):

- General-purpose copilots

- Coding/developer tools

- Industry-specific AI applications

2. Top 3 AI-Forward Enterprise Products (Based on Evidence)

From MS Copilot search results, the three products most consistently identified as leaders in AI transformation are:

- Microsoft Copilot 365 – Enterprise productivity

- Salesforce Einstein – Customer operations

- Databricks AI – Data & analytics

These are the only three platforms repeatedly cited as delivering scalable, measurable enterprise ROI across Fortune 500 deployments.

3. Review Summaries: Pros & Cons of the Top 3 Products

Below is a synthesized summary of online reviews, analyst commentary, and enterprise feedback.

Microsoft Copilot 365

Category: Enterprise productivity & knowledge work automation

Why it’s a leader: Highest ROI across 12 Fortune 500 deployments; 67% productivity gain reported.

Pros

- Massive productivity lift across documentation, email, meetings, and research tasks

- Deep integration with Microsoft 365 apps (Teams, Outlook, Word, Excel)

- Enterprise-grade security—favored by security-first organizations

- Fast adoption curve due to familiar UI and embedded workflows

Cons

- ROI depends heavily on change management; some teams underutilize features

- Quality varies by task (e.g., structured Excel tasks outperform creative writing)

- Cost concerns for large seat counts ($47/user/month)

- Requires strong data governance to avoid hallucinations or misclassification

Salesforce Einstein

Category: Customer operations (CRM, sales, service, marketing)

Why it’s a leader: Dominates customer operations AI; 34% conversion increase reported in enterprise deployments.

Pros

- Strong measurable impact on sales productivity and lead conversion

- Native integration with Salesforce CRM data

- Automates customer interactions (case routing, email generation, forecasting)

- Highly configurable for industry-specific workflows

Cons

- Expensive ($150/user/month) compared to other CRM AI add-ons

- Complex setup—requires admin expertise and clean CRM data

- Performance varies depending on data hygiene and org complexity

- Some users report “black box” behavior in forecasting and scoring models

Databricks AI

Category: Data & analytics (AI-native analytics platform)

Why it’s a leader: 11× growth in production AI models; 377% growth in vector databases for RAG apps.

Pros

- Best-in-class for AI model deployment at scale

- Unified data + AI platform simplifies pipelines

- Strong support for open-source LLMs (76% of enterprises use open-source models)

- Massive performance gains (89% faster insights) in analytics workflows

Cons

- Steep learning curve for non-data teams

- Costs can spike with GPU-heavy workloads

- Requires strong data engineering maturity

- Not ideal for small teams without ML expertise

Summary Table

|

Category |

Leading Product |

Why It Leads |

Key Pros |

Key Cons |

|

Productivity AI |

Microsoft Copilot 365 |

Highest enterprise ROI; deep M365 integration |

67% productivity gain; secure; fast adoption |

Cost; uneven usage; governance required |

|

Customer Operations AI |

Salesforce Einstein |

Best for sales/ service automation |

34% conversion lift; strong CRM integration |

Expensive; complex setup; data quality sensitive |

|

Analytics & AI Platforms |

Databricks AI |

Fastest-growing AI analytics platform |

11× model growth; open-source friendly |

Cost variability; steep learning curve |

AI Enterprise Leaders — Visual Comparison Table

|

Category |

Microsoft Copilot 365 |

Salesforce Einstein |

Databricks AI |

|

Primary Domain |

Productivity & knowledge work |

Customer operations (sales, service, marketing) |

Data, analytics & AI engineering |

|

Core Strength |

Deep integration across Microsoft 365 apps |

AI‑driven CRM automation |

Unified data + AI platform for large‑scale models |

|

AI Capabilities |

Text generation, summarization, meeting intelligence, workflow automation |

Lead scoring, forecasting, case routing, automated customer interactions |

Model training, vector search, RAG pipelines, analytics automation |

|

Enterprise ROI Themes |

Major productivity lift; reduced time spent on email, docs, meetings |

Higher conversion rates; faster case resolution |

Faster insights; scalable AI deployment |

|

Best For |

Organizations already on Microsoft 365 |

Companies with heavy CRM workflows |

Data‑mature enterprises building AI products |

|

Ease of Adoption |

High — familiar interface |

Medium — requires CRM hygiene |

Medium/Low — requires data engineering |

|

Cost Profile |

Moderate (per‑user licensing) |

High (premium add‑on) |

Variable (compute‑based) |

|

Pros |

- Strong security |

- Measurable sales lift |

- Open‑source friendly |

|

Cons |

- Requires governance |

- Expensive |

- Steep learning curve |

|

Ideal Org Size |

Mid‑market to enterprise |

Mid‑market to enterprise |

Enterprise & data‑heavy orgs |

|

AI Maturity Level Needed |

Low–Medium |

Medium |

High |

4. The Global AI Landscape Is Not Uniform

That’s great for North America, but different regions are moving at very different speeds, and for very different reasons. If we limit our analysis and summaries to North America, we miss some interesting contrasts.

Europe (EU + UK)

- Regulation-first environment

The EU AI Act is reshaping how enterprise AI is deployed. Vendors must adapt product features, risk classifications, and compliance workflows. - Higher emphasis on data sovereignty

European enterprises often prefer on‑prem or EU‑hosted AI models. - Slower but more controlled adoption

Enterprises move cautiously but with strong governance.

Asia (China, Japan, South Korea, Singapore, India)

- Hyper‑rapid adoption

Asia is the fastest‑moving region for enterprise AI, especially in manufacturing, fintech, and logistics. - Local AI ecosystems

China has its own AI giants (Baidu, Alibaba, Tencent) that compete directly with Western platforms. - Government‑driven acceleration

National strategies in Japan, Singapore, and South Korea push AI modernization aggressively.

Oceania (Australia + New Zealand)

- High cloud adoption

Enterprises here tend to adopt AI quickly because cloud modernization is already mature. - Strong alignment with US/UK vendors

Microsoft, Salesforce, and Databricks dominate, but with a regional focus on risk, ethics, and transparency.

5. Enterprise Priorities Shift by Region

Even when the same tools are used globally, the reasons for adopting them differ.

|

Region |

Primary AI Drivers |

Secondary Drivers |

|

North America |

Productivity, cost reduction, competitive advantage |

Developer acceleration |

|

Europe |

Compliance, risk management, data sovereignty |

Productivity |

|

Asia |

Scale, automation, national competitiveness |

Customer experience |

|

Oceania |

Operational efficiency, cloud modernization |

Workforce augmentation |

This is a powerful angle to include because it shows that “enterprise AI” is not a monolith.

6. Product Availability and Dominance Vary

The top three products — Copilot 365, Salesforce Einstein, Databricks AI — are global, but their market penetration differs.

Microsoft Copilot 365

- Strongest global footprint

- Particularly dominant in Europe and Oceania due to Microsoft 365 ubiquity

- Adoption in Asia varies depending on local cloud regulations

Salesforce Einstein

- Very strong in North America and Oceania

- Moderate in Europe

- Limited in parts of Asia where local CRMs dominate

Databricks AI

- Strong in North America and Europe

- Growing fast in Asia, especially India and Singapore

- Competes with local cloud providers in China

This provides a richer narrative: while the “top three” are global leaders, they are not universally dominant.

7. Cultural and Workforce Differences Matter

AI adoption is not just technical — it’s human.

Europe

- Strong worker councils

- AI adoption requires negotiation and transparency

- Higher resistance to automation replacing roles

Asia

- Higher cultural acceptance of automation

- Faster rollout of AI in operations and manufacturing

North America

- Strong appetite for productivity tools

- AI is framed as a competitive advantage

Written/published by Kevin Marshall with the help of AI models (AI Quantum Intelligence).